What is happening?

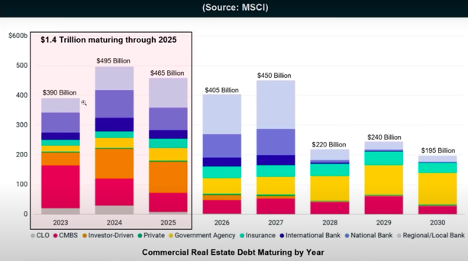

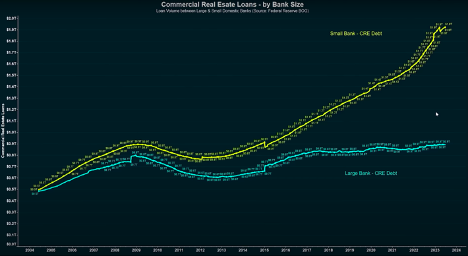

Declines in commercial real estate value, coupled with a significant amount of maturing debt, have the potential to send the global economy into a recession. According to the latest data from the RCA CPPI National All-Property Index, US commercial property prices for apartments, offices, and retail centers decreased by 11.2% in May 2023, marking the largest annual decline since May 2010. California has experienced a significant impact, as Los Angeles recorded a 22.5% vacancy rate for office spaces during the first quarter of 2023, compared to Manhattan’s 17% vacancy rate. The challenging cost of financing deals due to rising interest rates and limited availability of credit for commercial property investors have contributed to the downward pressure on property pricing and deal activity. Morgan Stanley expects that office and retail property values could decrease 40% from peak price, which would increase the risk of default. The largest office building in St. Louis, AT&T Tower, has decreased in value by 95% since it was purchased in 2006 for $200 million. Declines in commercial property values are intersecting with $1.5 trillion in real estate debt due for repayment before the end of 2025. The situation is worse for small banks that hold nearly $2 trillion in commercial real estate debt, compared to large banks that hold around $900 billion. The debt held by small banks accounts for 28.7% of their assets, compared to 6.5% at big banks. A significant percentage of those loans will require refinancing in the coming years. The Federal Reserve’s stress test results for 2023 include a global recession with 40% decline in commercial real estate prices, 10% unemployment rate, and 38% decline in home prices.

Who’s involved?

| Stakeholders | How much INFLUENCE / POWER do they have? (Low 1-5 High) | How much INTEREST do they have? (Low 1-5 High) | What are their MOTIVES / OBJECTIVES? | Ongoing and/or Recent Actions |

|---|---|---|---|---|

| Brookfield Corporation | 3 | 3 | • Cut losses – Brookfiled is looking to limit losses by selectively defaulting on some properties while negotiating loan extensions with banks to achieve more favorable loan terms for its properties such as office towers in Brooklyn and Denver | • Brookfield Corporation defaulted on $945,4 million in commercial real estate in 2023 in the US. The defaults account for 0.08% of the company’s total real estate assets. • Occupancy rates in defaulted offices averaged 52%, down from 79% in 2018. In comparison, monthly mortgage payments increased from $300,000 to $880,000 over the last 12 months due to interest rate hikes. |

| Banc of California and PacWest Bancorp | 4 | 5 | • Prioritized high-yield investments – PacWest catered to venture capital, private equity customers, and affordable housing developers in California • Prevent the fallout – PacWest tried to avoid the merger by restructuring its senior management ranks, offloading $1 billion of bonds at a loss to pay off higher-interest borrowings, and required borrowers to have a deposit in order to get a loan. | • Banc of California and PacWest Bancorp will merge in an all-stock deal to create a bank with $36 billion in assets • Almost 80% of PacWest’s loans were dedicated to commercial real estate and residential mortgages. |

| The Federal Reserve | 5 | 4 | • Encourage banks to accept credit-risky borrowers – the Federal Reserve’s recent guidance recommends that banks grant short-term loan accommodations, which include agreeing to defer payments, accepting partial ones, or providing other assistance. | • The Federal Reserve says all 23 big banks that could withstand a severe recession. No information was found about stress testing small and mid-sized banks. • The Fed increased interest rates to 5.25% – 5.5% range and announced another possible increase in September, with no chance of cutting rates this year. |

What are the likely responses?

Whether the decrease in commercial real estate value will extend to a major risk in the global economy depends on the outcomes of the US’ interest rate hike cycle, and the demand for office space that decreased due to the remote work trend triggered by the pandemic. The latest announcement by the Fed indicates their strong expectation of economic slowdown, “hoping for a soft landing scenario without a really significant downturn resulting in job losses and recession.” The Fed doesn’t intend to reduce interest rates by the end of the year, and their message suggests that recession is evident, but the question is how big will it be?

The decline in property values is expected to have a severe impact on property taxes across all asset classes, leading to significant budgetary challenges for the entities relying on these taxes. Communities like downtown LA will have significantly less tax revenue in the coming period. Government regulators and policymakers will be forced to implement new measures to support the real estate sector and prevent economic crises. Such measures could include targeted stimulus packages, relaxation of certain regulatory requirements, or facilitating the conversion of commercial properties to residential. According to the Fed’s latest stress test, big banks will continue lending despite heavy losses, and more bank mergers will be necessary. The Federal Reserve’s decision to stress test only big banks, while excluding small and mid-sized banks that hold two-thirds of total commercial real estate debt, suggests an intention to prevent nationwide panic and withdrawals by selectively presenting the banking system’s vulnerabilities.

Real estate companies will either sell their assets at a loss to accommodate deposit holders, or convert their buildings to residential spaces. One transformation is currently being experimented with in Manhattan’s Financial District, where the biggest US office-to-apartment conversions is currently underway. This project is a test case of whether office-to-housing conversions can work in big cities. If approved, it could add up to 20,000 new homes for as many as 40,000 residents. The speed of such changes largely depends on stabilizing interest rates and inflation, which would provide the ability to assess costs, returns, and property values accurately.

Business owners should adapt their office layouts and leasing strategies to reflect the changing trends in the industry. They should consider implementing more hoteling options, which involve reservation-based use of unassigned workspaces. This allows employees to choose their workspace according to their needs for the day, promoting flexibility and collaboration.

Moreover, business owners should focus on providing more practical and user-friendly amenities, moving away from “frivolous” perks like ping pong and pool tables. Instead, they should prioritize better food services and amenities that enhance the overall work environment, productivity, and employee well-being.

Sources:

- RCA CPPI™ US Commercial property price indexes https://www.msci.com/documents/10199/55bf277a-08c6-7464-a23a-a0564d2a20de

- The Banker “Commercial real estate markets deteriorate as interest rates rise” https://www.thebanker.com/Commercial-property-market-under-stress-1686651435

- JPMorgan “2023 midyear commercial real estate outlook” https://www.jpmorgan.com/insights/real-estate/commercial-real-estate/midyear-commercial-real-estate-outlook

- St. Louis Business Journal “Another buyer lined up for massive, long-vacant AT&T tower” https://www.bizjournals.com/stlouis/news/2022/01/13/att-tower-bondholders-buyer-appraisal-value-lower.html

- Bloomberg “A $1.5 Trillion Wall of Debt Is Looming for US Commercial Properties” https://www.bloomberg.com/news/articles/2023-04-08/a-1-5-trillion-wall-of-debt-is-looming-for-us-commercial-properties#xj4y7vzkg

- JPMorgan “Are banks vulnerable to a crisis in commercial real estate?” https://privatebank.jpmorgan.com/gl/en/insights/investing/are-banks-vulnerable-to-a-crisis-in-commercial-real-estate#footnote1

- The New York Times “Concerns Grow as Tighter Lending Threatens Commercial Real Estate” https://privatebank.jpmorgan.com/gl/en/insights/investing/are-banks-vulnerable-to-a-crisis-in-commercial-real-estate#footnote1

- The Global Times “Observers caution risk over commercial property bubble in US” – https://www.globaltimes.cn/page/202304/1289416.shtml

- Bloomberg “PacWest Bosses Were Trying to Start Over. Then SVB Failed” – https://www.bloomberg.com/news/articles/2023-05-26/how-pacwest-tried-to-save-itself-before-svb-collapse

- Reuters “Banc of California and PacWest to merge, raise $400 million in equity” – https://www.reuters.com/markets/deals/banc-california-talks-buy-pacwest-bancorp-wsj-2023-07-25/

- The Banker “Banc of California to buy PacWest” – https://therealdeal.com/la/2023/07/25/banc-of-california-negotiates-to-buy-pacwest/

- Euro Dollar University “Federal authorities freaking out trying to limit the fallout” – https://www.youtube.com/watch?v=J_lxIcaGxQQ&t=64s

- Investopedia “What Is a Credit Crunch?” – https://www.investopedia.com/terms/c/creditcrunch.asp

- Reuters “US regulators ask lenders to work with stressed commercial real estate firms” – https://finance.yahoo.com/news/us-regulators-ask-lenders-stressed-204843233.html

- Reuters “Fed lifts rates, Powell leaves door open to another hike in September” – https://www.reuters.com/markets/rates-bonds/fed-poised-hike-rates-markets-anticipate-inflation-endgame-2023-07-26/

- Quartz “The biggest office-to-residential conversion project in the US is underway” https://qz.com/the-biggest-office-to-residential-conversion-project-in-1850455241

- Reventure Consulting “2023 Recession just hit Commercial Real Estate (90% drop in prices)” https://www.youtube.com/watch?v=Ntz7RnTyOXo