What’s Happening?

The increase in gold buying by central banks is part of a decades-long shift away from the US dollar as the world’s primary reserve currency, driven by the BRICS alliance between Brazil, Russia, India, China, and South Africa. In 2022, central banks’ demand for gold accumulated to the highest levels since 1950, during the period when the US dollar was still backed by gold. In Q1 2023, central banks demand for gold increased by 176% YoY, making it the strongest first-quarter performance on record, even though the figures were lower than those observed in the previous two quarters.

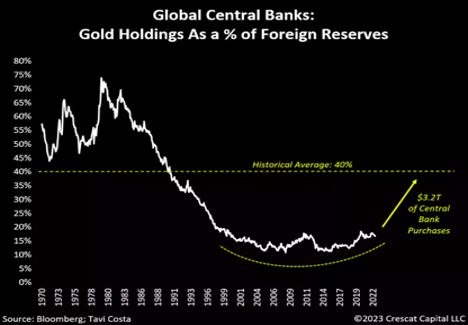

After the official decoupling of the US dollar from gold in 1971 and the complete abandonment of the gold standard in 1973, central banks have turned to gold as a safeguard during periods of market volatility and uncertainty. Gold has become a hedge against the US dollar, particularly during times of high inflation and political tensions involving the United States, which were the key reasons for the record demand in 2022. In recent times, central banks from emerging markets have been at the forefront of buying gold, indicating concerns over international relations and a growing desire for greater independence from the US monetary system.

Why?

| Driving Forces | Weight (0-5) | Trend | Weight (0-5) | Restraining Forces |

|---|---|---|---|---|

| Geopolitical Uncertainty | 5 | Central banks’ demand for gold in record levels | 5 | Gold supply is limited and surging demand would increase the price and make gold overvalued |

| High Inflation | 4 | |||

| Decreased reliance on the US dollar as the global reserve currency | 3 | 2 | “A key issue not yet addressed by BRICS CBDC project mBridge is how to support a foreign currency not represented by the participant central banks, such as the US dollar,” according to Ledger Insights. | |

| Creation of BRICS digital currency with gold serving as the basis for backing the value. | 2 | 4 | The alternative to the US dollar isn’t a group of growing countries, but dominant China whose GDP comprises 72% of the BRICS nations. | |

| Bitcoin has no direct ties to BRICS currency or the US dollar, yet it remains subject to their influence. The potential approval of a Spot Bitcoin ETF by the SEC paired with ongoing developments in BRICS’ currency initiatives would undoubtedly increase the price of Bitcoin. | 1 | 3 | By joining the bloc, countries would increase trade with China and decrease trade with the United States. |

What’s Next?

The survey by the World Gold Council in May 2023 revealed that 24% of central banks intend to increase their gold holding reserves in the next 12 months. Central banks’ views about the future role of the US dollar were more pessimistic than in previous surveys. Around a half of central banks believe the percentage of reserves in USD will fall by 10% – 20% in the next 5 years, while just over a quarter believe it will remain unchanged. On the other hand, central banks’ perspectives on the future role of gold became more optimistic, with 62% indicating that gold’s share in total reserves will increase, as opposed to 46% in the previous year. When looking closer at the central bank buyers, 9 of the top 10 are in the developing world, including Russia, India and China. Not coincidentally, these countries are negotiating with Brazil and South Africa about creating a new currency to challenge the dollar.

The relationship between the strength of the US dollar and the price of gold is generally inverse. When the dollar is strong, gold prices tend to fall, and when the dollar is weak, gold prices tend to rise. During the banking crisis in March, gold kept rising while the dollar went down. The difference in the movement of the two has never been so big. As of August 2023, Fitch credit agency has downgraded the US credit rating by a single grade, pushing away foreign investors and reassuring gold as a superior risk-free alternative. The anticipated increase in the demand for gold in the next 12 to 18 months suggests that the US dollar’s value will almost certainly fall in the future as more businesses and individuals choose to move their investments away from assets denominated in US dollars to precious metals. There aren’t exact alternatives to gold, although silver is also considered a safe haven during times of economic uncertainty, but is more volatile than gold.

Readers should follow the outcomes of the BRICS’ summit from August 22-24. A South African representative reported that BRICS currency won’t be on the agenda, and that the talks will be focused around adding new members and expanding trade in local currencies. Adding new members would negatively affect the price of the dollar, as they move away from using the US dollar for trading within the bloc. Adding new members could further increase the price of gold, as member central banks may decide to continue buying gold at high rates to prepare for a potential BRICS currency.

For Further Reading:

- Crescat Capital – “Gold: A Far Superior Alternative” – https://www.crescat.net/gold-a-far-superior-alternative/

- Financial Times – “What strong gold says about the weak dollar” – https://www.ft.com/content/e9c78b99-8a29-47e2-b5bf-9f7542608cf6

Sources:

- Reuters – “Central banks bought the most gold on record last year, WGC says” – https://www.reuters.com/markets/commodities/central-banks-bought-most-gold-since-1967-last-year-wgc-says-2023-01-31/

- World Gold Council – “Gold Demand Trends Full Year 2022” – https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-full-year-2022/central-banks

- World Gold Council – “2023 Central Bank Gold Reserves Survey” – https://www.gold.org/goldhub/data/2023-central-bank-gold-reserves-survey

- Council on Foreign Relations – “The Dollar: The World’s Reserve Currency” – https://www.cfr.org/backgrounder/dollar-worlds-reserve-currency

- OpenRecon – “BRICS Expansion is Creating a Push for De-Dollarization” – https://openrecon.com/2023/07/07/brics-expansion-is-creating-a-push-for-de-dollarization/

- Forbes – “The BRICs Go For Gold” – https://www.forbes.com/sites/nathanlewis/2023/07/16/the-brics-go-for-gold/?sh=4d1f1d785eb3

- Watcher.guru – “How BRICS Gold-Backed Currency Will Affect Bitcoin” – https://watcher.guru/news/how-brics-gold-backed-currency-will-affect-bitcoin

- Ledger Insights – “The MBridge multi-CBDC for cross border payments is on a path to production” – https://www.ledgerinsights.com/mbridge-multi-cbdc-cross-border-payments/

- Financial Times – “Why a Brics currency is a flawed idea” – https://www.ft.com/content/02d6ab99-ea36-41c4-9ad3-9658bb1894a7

- Kitco – “JPMorgan Chase sees gold prices at record highs in 12 to 18 months” – https://www.kitco.com/news/2023-07-26/JPMorgan-Chase-sees-gold-prices-at-record-highs-in-12-to-18-months.html

- US News – “Should You Invest in Silver as an Inflation Hedge?” – https://money.usnews.com/investing/investing-101/articles/how-to-invest-in-silver

- Bloomberg – “South Africa Says BRICS Will Move Forward on Expansion at Summit” – https://www.bloomberg.com/news/articles/2023-08-02/south-africa-sees-tectonic-shift-in-world-order-at-brics-summit#xj4y7vzkg