What is happening?

Increasing adoption of blockchain systems for cross-border transactions signifies a transformative shift for executing fast, safe, and cost-effective foreign currency payments. In June 2023, JP Morgan & Chase Co. partnered with six major banks in India to launch a blockchain-based distributed ledger technology (DLT) called Onyx, to settle interbank dollar transactions. The technology allows selected Indian private financial institutions to exchange, send, and receive US dollars 24/7, unlike the traditional settlement system that takes a few hours or days to complete and prevents transactions from finalizing over weekends and public holidays.

JP Morgan’s Onyx is a payment rail and deposit account ledger that allows participating clients to share sensitive data, transfer and clear multiple currencies, and convert traditional assets into digital ones using blockchain technology through its platform. To execute transactions on the deposit account ledger, banks have to open on-chain foreign currency accounts with JP Morgan.

“The interbank dollar clearing pilot is only a small beginning. We see a future for the shared ledger platform as an alternative to existing cross-border payments,” said Naveen Mallela, managing director and head of Onyx Global Coin Systems at JP Morgan.

What is causing it to happen?

“India has arguably the most advanced global payment infrastructure, and Onyx is the next add-on to the infrastructure,” Mallela added. The project’s headquarters is the Gujarat International Finance Tec-City, or GIFT City, which represents India’s attempt to establish an international finance hub alike Singapore. In 2015, GIFT city was declared a Special Economic Zone (SEZ) to promote economic growth by providing favorable tax treatment for domestic and international businesses.

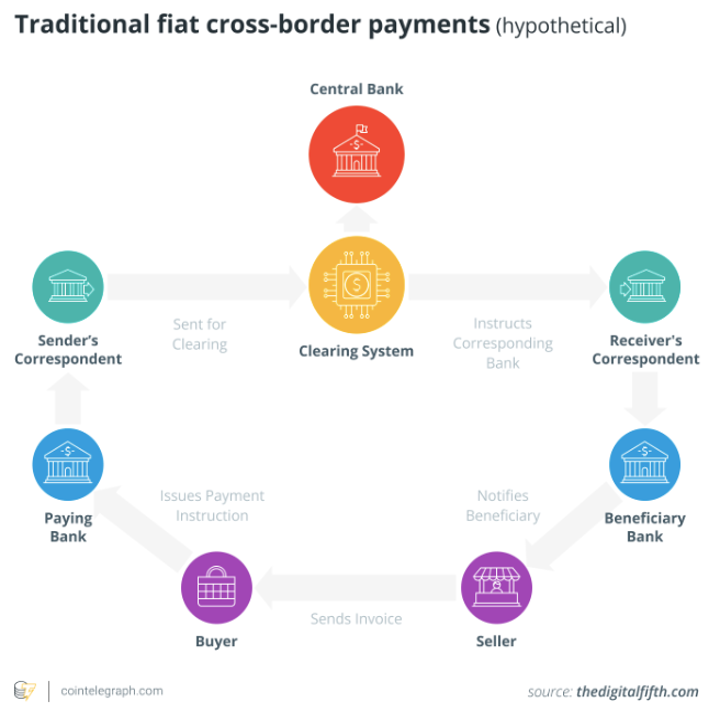

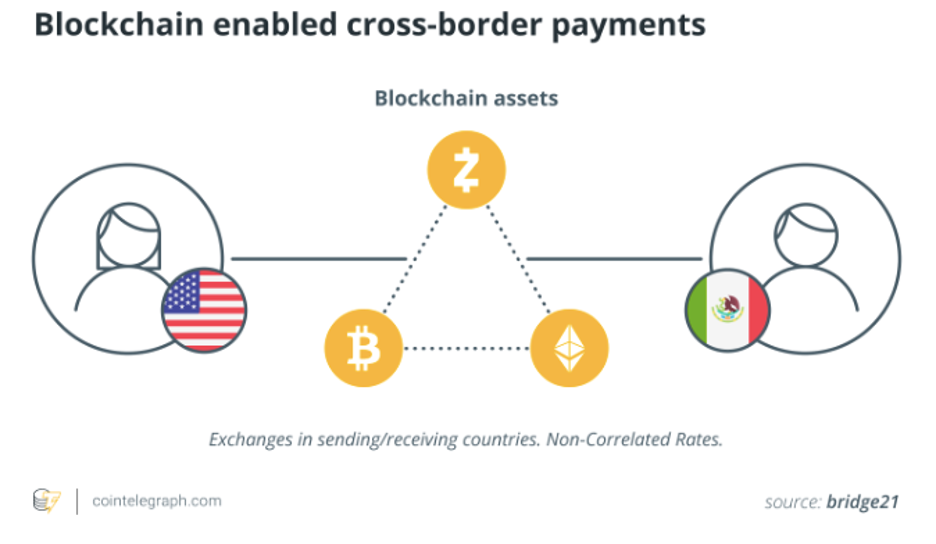

Foreign currency fund transfers are executed by debiting and crediting foreign currency accounts that a domestic bank has in a different country’s bank. This system includes commercial banks, clearing houses, credit unions, and other financial services institutions, that profit from settling cross-border transactions by charging fees. The web of intermediaries increases the cost of facilitating payments and slows down the transaction process because of different time zones and operating hours. Blockchain enables the processing of cross border payments within seconds rather than days, and brings a 40–80% reduction in transaction costs. The technology ensures top security and traceability of payment information.

What is likely to happen?

“The global blockchain technology market size was valued at $11.14 billion in 2022 and is projected to grow from $17.57 billion in 2023 to $469.49 billion by 2030,” according to Fortune Business Insights. Increasing blockchain adoption will almost certainly lead to a profound shift in cross-border transactions, empowering businesses and individuals to send payments more seamlessly across borders. However, significant investment by banks is necessary to upgrade their back-office applications to support the systems’ needs.

Aside from banks, the majority of financial technology providers cannot meet the liquidity requirements necessary to manage large or intense payment flows such as international trade, direct investments, or high-volume commerce. Banks are highly likely to be the primary drivers for industry growth in the future because they maintain a superior level of trust for handling transactions. This will only be more important in the future as damage from cyberattacks is estimated to amount to$10.5 trillion annually by 2025 – a 300% increase from 2015 levels. One of JP Morgan’s biggest competitors for cross-border transactions is Ripple, a blockchain system present in over 50 countries that allows banks to access a standardized network of institutions for faster payments. Ripple’s CEO Brad Garlinghouse criticized the concept of bank issued digital coins citing its centralized nature. JP Morgan’s coin is backed by US dollars, representing a liability on the lender’s balance sheet. “If banks of different digital asset groups want to settle trades with one another, they’ll have to make markets between their unique digital assets or trade between their digital assets and a common fiat currency. What a mess!,” Garlinhouse wrote.

Sources

- https://economictimes.indiatimes.com/industry/banking/finance/banking/banks-set-to-pilot-dollar-clearing-and-settlement-at-ifsc/articleshow/98789467.cms

- https://www.fortunebusinessinsights.com/industry-reports/blockchain-market-100072

- https://www.scnsoft.com/blockchain/cross-border-payments

- https://www.cbinsights.com/research/blockchain-disrupting-banking/

- https://cointelegraph.com/explained/what-are-cross-border-payments-and-how-do-they-work

- https://www.mckinsey.com/~/media/McKinsey/Industries/Financial%20Services/Our%20Insights/A%20vision%20for%20the%20future%20of%20cross%20border%20payments%20final/A-vision-for-the-future-of-cross-border-payments-web-final.ashx

- https://www.thebanker.com/Transactions-Technology/Why-banks-have-valuable-capital-in-the-bid-to-power-low-value-cross-border-payments

- https://www.linkedin.com/pulse/case-against-bankcoin-brad-garlinghouse/

- https://www.thehindu.com/business/gift-city-explained-history-tax-incentives-of-indias-first-smart-city/article65736969.ece