The Brazil Russia India China and South Africa (BRICS) alliance is discussing the creation of a new currency and separation from the US dollar at an upcoming summit, with several countries expressing interest in joining the bloc. The move is fueled by concerns over the dominance of the US dollar, exacerbated by the instability of the current financial system and the United States’ ability to impose global sanctions through its control over the financial system.

What is happening?

In August 2023, foreign ministers from more than a dozen countries will attend a BRICS summit to discuss separation from the US dollar, the creation of BRICS currency, and the potential acceptance of new members. The alliance between Brazil, Russia, India, China, and South Africa was appointed by 19 countries that expressed interest in joining the bloc. Argentina, Egypt, Indonesia, Saudi Arabia, and the United Arab Emirates are the countries expected to join the alliance in the short term.

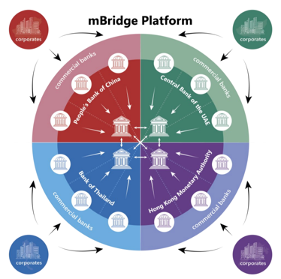

The BRICS countries have been actively seeking alternatives to reduce their dependence on the US dollar. In October 2022, the alliance successfully conducted cross-border central bank transactions by using Central Bank Digital Currencies (CBDCs) via blockchain technology. Known as Project mBridge, the technology provides a multi-CBDC platform that allows its member countries to issue and exchange digital assets, eliminating the need for financial intermediaries in the cross-border transaction process. The benefits of this technology include fast, low-cost, secure, and transparent transactions. “A key issue not yet addressed by mBridge is how to support a foreign currency not represented by the participant central banks, such as the US dollar,” according to Ledger Insights.

What is causing it to happen?

The Covid-19 pandemic followed by the war in Ukraine has caused governments around the world to reconsider their geo-political positions, with 19 countries that expressed interest in joining BRICS. The United States produced over 4 trillion dollars in light of these events and froze Russia’s $640 billion in foreign exchange reserves, raising concerns about the county’s substantial economic authority. “The US dollar is the premier international currency across all uses – trade invoicing, trade financing, cross-border payments, and funding in global capital markets. The dollar was used for 88% of all foreign exchange trades in April 2022,” according to the Bank of International Settlements (BIS). This dominance gives the United States the power to cut off financial supplies to any country.

While the BRICS countries have been seeking to reduce their reliance on the US dollar for years, the United States’ sanctions on Russia after its attack on Ukraine have accelerated the process. The consequences of sanctions are higher oil and food prices worldwide, with countries realizing that United States sanctions are essentially global sanctions. For example, when the United States reinitiated sanctions on Iran in 2018, the European Union nations were still free to do business with Iran, but to do so they would need to avoid interacting with US companies, US banks, or the US dollar. This was nearly impossible and as a result, Iran’s oil trade declined by 92.8% between 2018 and 2019. Besides the high degree of economic control, the trust in the financial system dominated by the US dollar has decreased in recent years due to the repetitive lifting of the debt limit. The rising debt limit implies that the United States relies on issuing new debt to cover existing obligations. The fragility of the system and the United States’ high degree of economic control are primary incentives for countries that seek to join BRICS.

What could happen next?

The US dollar now accounts for 58% of global reserves, compared to 73% in 2001. These numbers along with BRICS expansion prove the de-dollarization trend but the question is how far it will go. The United States’ superiority reflects in open capital markets, functioning bond markets, and a developed system of corresponding banks that each contribute to the dollar’s unmatched liquidity compared to other currencies. Decades of reliability in the functionality, rather than sustainability, of the American financial system have led to the worldwide adoption of the US dollar. Over 4 trillion dollars were approved in response to the Covid-19 pandemic followed by rising interest rates, bank failures, and debt suspension are raising concerns about the sustainability of the American financial system.

To match the functionality of the existing financial system, the mBridge platform provides a common digital infrastructure that can facilitate fast, low-cost, secure, and transparent cross-border CBDC transactions. The transformation into blockchain banking using CBDC allows countries to bypass financial intermediaries and reduce dependence on the US dollar. According to the Atlantic Council, 130 countries representing 98% of global GDP are exploring CBDCs. The source claims that the European Central Bank is on track to begin its pilot for the digital euro, which is expected to be in circulation by 2027. If commercial banks want to settle trades using digital currencies issued by central banks, they will have to make markets between unique digital assets or trade their digital assets and a common fiat currency. Switzerland, Hong Kong, Singapore, and other countries are currently developing regulatory frameworks for creating digital currency exchanges. There is still a long way to go before digital currencies enter circulation due to policy, legal, governance, and systematic issues. Recent legislation by the Governor of Florida regarding the implementation of a Central Bank Digital Currency by the Biden Administration brings attention to complex issues surrounding surveillance and control. The law prohibits the usage of a CBDC as a form of legal tender of currency within the state. While proponents argue that a CBDC can enhance transparency, the governor expressed concerns about individual privacy and economic freedom. For now, the US dollar remains superior, but its long-term future is uncertain due to the entirely new financial system the world is turning to.

Sources:

- “Central Bank Digital Currency Tracker” – https://www.atlanticcouncil.org/cbdctracker/

- “Project mBridge” – https://www.bis.org/publ/othp59.htm

- “The innovator’s dilemma and US adoption of Digital Dollar” – https://www.brookings.edu/articles/the-innovators-dilemma-and-u-s-adoption-of-a-digital-dollar/

- “Global Food Crisis tests Western Resolve to Retain Russia Sanctions” – https://www.nytimes.com/2022/06/27/business/russia-food-crisis-sanctions.html

- “BRICS Draws Membership Bids from 19 Nations Before Summit” – https://www.bloomberg.com/news/articles/2023-04-24/brics-draws-membership-requests-from-19-nations-before-summit

- “The MBridge multi-CBDC for cross border payments is on a path to production” – https://www.ledgerinsights.com/mbridge-multi-cbdc-cross-border-payments/

- “BRICS countries likely to induct five new members in August summit” – https://www.business-standard.com/economy/news/brics-countries-likely-to-add-five-new-members-during-august-summit-123062900836_1.html

- “The Biden Administration Has Approved $4.8 Trillion of New Borrowing” – https://www.crfb.org/blogs/biden-administration-has-approved-48-trillion-new-borrowing

- “Why the dollar keeps winning in the global economy” – https://www.reuters.com/breakingviews/global-markets-breakingviews-2023-02-28/

- “Global exchange rate adjustments: drivers,impacts and policy implications” – https://www.bis.org/publ/bisbull62.pdf

- “The Federal Response to COVID-19” – https://www.usaspending.gov/disaster/covid-19?publicLaw=all

- “Ride Out Talks of De-Dollarization With 5 ETF Strategies” – https://finance.yahoo.com/news/ride-talks-dollarization-5-etf-170005022.html

- “Debt Limit Suspensions” – https://crsreports.congress.gov/product/pdf/IN/IN11829

- “The Growing Revolt Against the US Dollar” – https://www.youtube.com/watch?v=g6rFff2MAxM

- “The Banking Crisis: A Timeline of Key Events” – https://www.wsj.com/articles/bank-collapse-crisis-timeline-724f6458

- “Fed raises interest rates 0.25%, escalating inflation fight amid banking woes” – https://abcnews.go.com/Business/fed-raises-interest-rates-025-escalating-inflation-fight/story?id=99039090#:~:text=Interest%20Successfully%20Added-,Fed%20raises%20interest%20rates%200.25%25%2C%20escalating%20inflation%20fight%20amid%20banking,and%20economic%20slowdown%20this%20year.&text=The%20rate%20hike%20marks%20the,effort%20to%20help%20curb%20inflation.

- “CBDC projects pick up the pace as 2023 kicks off” – https://www.americanbanker.com/payments/list/cbdc-projects-pick-up-the-pace-as-2023-kicks-off#:~:text=BNY%20Mellon%2C%20Citigroup%2C%20PNC%2C,along%20with%20Mastercard%20and%20SWIFT.

- “Governor Ron DeSantis Announces Legislation to Protect Floridians from a Federally Controlled Central Bank Digital Currency and Surveillance State” – https://www.flgov.com/2023/03/20/governor-ron-desantis-announces-legislation-to-protect-floridians-from-a-federally-controlled-central-bank-digital-currency-and-surveillance-state/