What’s happening?

The Russian government has confirmed that the BRICS countries intend to launch a new trading currency backed by gold. The development of a BRICS gold-standard currency is a challenge to the dominance of the US dollar in the global financial system. The geopolitical uncertainty that has been created by the leverage the U.S. government has on the U.S. dollar against Russia for invading Ukraine has led some nations allied with Russia to consider diversifying their reserves away from the U.S. dollar. Ambassador Anil Sooklal, South Africa’s top diplomat in charge of relations with the BRICS group of nations, said in February 2023, that more than 40 countries have expressed interest in joining.

What’s causing this to happen?

In recent years, China has been growing its gold holdings as part of a bigger strategy to issue a gold-backed currency. Leslie Maasdorp, vice president and chief financial officer of the New Development Bank (NDB), said that the development of a common currency is a medium- to long-term ambition. The NDB is a multilateral development bank established by the BRICS countries in 2014. The bank has an authorized capital of $100 billion, and its headquarters are located in Shanghai, China. In the first five years of operation, the bank approved loans totalling $18.9 billion for 65 projects in 34 countries. The NDB plans to add several new emerging market member countries this year in a bid to expand its lending capability. The bank added new members such as Bangladesh, Egypt, the United Arab Emirates, and Uruguay. On June 1, 2023, former Brazilian President Dilma Rousseff, the current president of the New Development Bank (NDB), announced that Argentina, Saudi Arabia, and Zimbabwe had been approved as new members. The NDB plans to add several new emerging market member countries this year in a bid to expand its lending capability, proving that the world is transitioning toward a multipolar currency order.

The U.S. Federal Reserve has raised interest rates by 75 basis points since March 2022 in an effort to combat inflation. The Fed’s target range for the federal funds rate is now between 1.50% and 1.75%, up from 0% to 0.25% in March. The Fed’s goal is to bring inflation back to its 2% target. This has put downward pressure on the currencies of many Global South nations, such as Brazil, India, Argentina, and South Africa, making it more expensive to import foreign products and pay off dollar-denominated debt. This is also a reason why a diversified global currency system would give countries more options when it comes to international trade and investment.

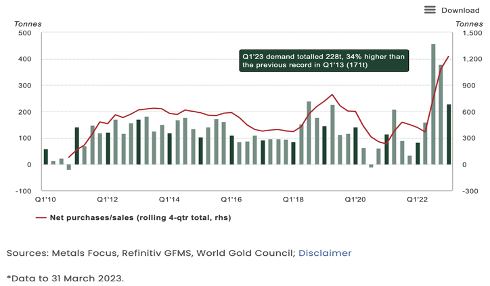

In response to US sanctions against Russia following its invasion of Ukraine, and impacting factors such as the decline of the US economy, and the rise of cryptocurrencies, global central banks have been diversifying away from US assets and the US dollar and purchasing gold in recent months. In fact, according to the World Gold Council, central banks purchased a net of 1,136 metric tons of gold in 2022, the most since 1967.

What could happen next?

The announcement of a gold-backed BRICS currency could possibly lead to increased demand for gold and potential price appreciation. This is because the supply of gold is limited, so increased demand could put upward pressure on prices. Retirement accounts in the US are often heavily invested in traditional assets like stocks, bonds, and mutual funds. However, the introduction of a new gold-backed currency could increase interest in safe-haven assets, including physical gold. Gold is considered a safe-haven asset because it is not subject to the same political and economic risks as other assets. Inflation and geopolitical concerns can be mitigated by including gold in retirement accounts like Gold IRAs.

Over the past couple of years, Bitcoin (BTC) has gained prominence as it is a decentralized cryptocurrency, meaning that it is not subject to government control. Robert Kiyosaki, an investor and author, has been a vocal advocate of gold, silver, and bitcoin for many years. According to his tweet, he predicted that the price of BTC will hit $120,000 in 2024 while referring to the revised forecast by Standard Chartered, which said that BTC could reach $50,000 by the end of 2023 and $120,000 in 2024. In February 2023, he said that BTC would hit $500,000 by 2025, gold would hit $5,000, and silver would reach $500. Although some countries, such as El Salvador, have made Bitcoin legal tender, others, such as China, have banned all cryptocurrency trading and mining. Still, other countries, such as the United States, are taking a more cautious approach. Kiyosaki has also made his own predictions about the future price of gold, silver, and bitcoin. In 2017, the BRICS countries’ central banks issued a joint statement saying that they were exploring the potential of using distributed ledger technology (DLT) to develop international payment arrangements. This is a sign that the BRICS countries are interested in creating their own cryptocurrency. In 2020, the BRICS countries’ central banks announced that they were working on a prototype for a central bank digital currency (CBDC), a digital version of a fiat currency. The BRICS countries’ CBDC project is still in its early stages, but if it is successful in creating CBDC, it could have a significant impact on the way money is transferred and stored around the world.

Central bank demand hits Q1 record, maintaining its upward trend

Sources: