What is happening?

Fitch, among the top three credit rating agencies alongside Moody’s and S&P, will maintain the US “AAA” credit rating on negative watch, indicating it could downgrade US debt despite the passed legislation that allows the government to meet its payment obligations. S&P downgraded the US credit rating after a similar standoff over the debt limit in 2011. Moody’s would downgrade the US credit rating only if the Treasury failed on its debt, which is highly unlikely since President Joe Biden signed a bill that suspends the debt ceiling until January 1, 2025.

What is causing it?

America has a perfect credit rating from Fitch and Moody’s because of its preeminent status in the financial world. The US dollar is the global reserve currency, and US Treasuries are treated as risk-free assets in the minds of investors. Those two characteristics currently give the United States unrivaled financial power. However, Fitch said that “repeated political standoffs around the debt limit and last-minute agreements before the X-date (when the Treasury can no longer meet its financial obligations) lowers confidence in governance on fiscal and debt matters.” The political conflicts surrounding the debt limit increase led to investor uncertainty about the risk-free status of US Treasury securities. Debt securities issued by the US Department of the Treasury are considered to be risk-free because the “full faith and credit” of the US government backs them.

What is likely to happen?

S&P’s decision to lower the US credit rating in 2011 triggered a global selloff that led to Wall Street’s worst day since the 2008 financial crisis and raised fears of a new recession, but the aftermath demonstrated that US Treasuries retained their status as a safe haven.

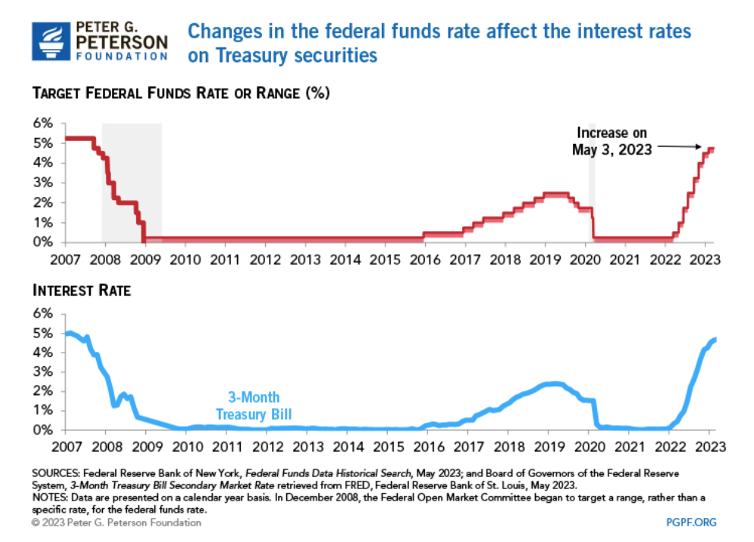

If the country’s credit were to be downgraded yet again, the yields on Treasury securities would almost certainly increase, with investors demanding higher returns to compensate them for the increased chance they won’t be paid back. Higher yields on short-term securities increase the US government’s borrowing costs. Rising interest rate on short-term Treasury securities is directly correlated with the fed fund rate that banks use as a benchmark to determine lending and borrowing rates. Rising fed fund rate forces banks to keep more money in reserves, reducing their ability to issue new loans. It could eventually become too expensive for small and mid-size banks to finance new loans, likely resulting in more bank defaults or acquisitions in the short term. A decrease in the capital available for lending would have negative consequences for small businesses as it would limit their ability to borrow funds.

Currently, US securities are seen as a safe asset and a one-tick downgrade from a single credit agency wouldn’t threaten that status in the short term, said Ryan Sweet, chief US economist at Oxford Economics. Considering the high interest rates and expected issuance of nearly $1.1 trillion in new Treasury bills over the next seven months, individuals and private companies are more likely to invest in short-term Treasury bills than keep their funds in banks’ savings accounts.

Sources:

- https://www.cnn.com/2023/06/02/economy/fitch-credit-downgrade-warning/index.html

- https://www.cnn.com/2023/06/03/politics/biden-signs-debt-ceiling-deal/index.html

- https://www.reuters.com/markets/us/us-corporate-debt-binge-could-be-hard-sustain-2023-06-01/#:~:text=Near%2Dterm%20funding%20costs%20are,estimates%2C%20to%20replenish%20its%20coffers.

- https://www.reuters.com/markets/us/fitch-keeps-us-credit-rating-negative-watch-despite-debt-limit-deal-2023-06-02/

- https://www.investopedia.com/us-credit-downgrade-impact-7504529

- https://www.forbes.com/sites/roberthart/2023/05/25/fitch-puts-us-aaa-credit-rating-on-negative-watch-heres-why-it-matters/

- https://finance.yahoo.com/news/another-downgrade-of-americas-credit-rating-might-be-coming-192337067.html

- https://www.wsj.com/articles/fitch-says-u-s-on-rating-watch-negative-f0434027?mod=Searchresults_pos3&page=1