What’s happening?

Layoffs are currently happening in various industries, but some of the hardest-hit sectors include tech, retail, real estate, and logistics. Numerous well-known businesses such as Google, Meta, Microsoft, and Amazon have laid off workers, and they represent the full spectrum of the tech industry, including social media, streaming, e-commerce, and artificial intelligence. It’s crucial to remember that not all industries are experiencing layoffs. Healthcare and education are two fields that are still hiring. Although there is an overall trend towards layoffs, more industries are expected to be impacted in the coming months. The tech industry increased its layoffs by 649% in 2022. More than 1,040 people were laid off from US-based tech companies in the last week of June 2023. In 2023, more than 151,054 workers in US-based tech companies were laid off, and in 2022, more than 93,000 jobs were slashed from public and private tech companies in the U.S.

What caused this to happen?

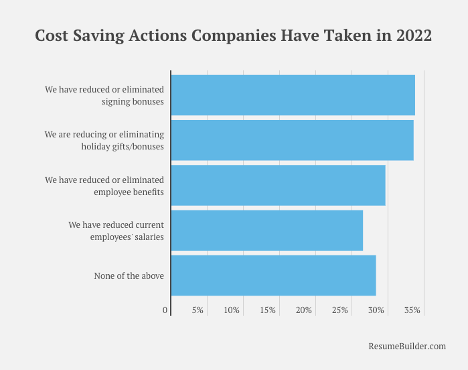

The International Monetary Fund (IMF) has issued pessimistic predictions for global GDP (Gross Domestic Product) growth in 2022 and 2023 in conjunction with the pandemic and ongoing Russia-Ukraine conflict. Most companies, including the big tech ones, worry about the economic recession and rising inflation in most countries. Businesses look for cost-cutting opportunities to offset their increasing expenses due to inflation. One of the initial cost-cutting actions is frequently to lay off employees.

The reserves held by tech corporations total tens of billions and sometimes hundreds of billions of dollars, and none of these companies are on the verge of bankruptcy. Software companies are typically very capital-intensive businesses. As a result, they need to generate a lot of revenue to be profitable. Investors are more interested in revenue per employee, which has decreased in recent years due to hiring sprees during the pandemic. Revenue per employee is a financial measure of how efficiently a company is using its resources. Investors or companies’ management often look at other financial, performance, and strategic metrics to make decisions regarding productivity and efficiency. A low revenue per employee means that the company is not generating profits and is not using its resources as efficiently. According to Michael Cusumano, the deputy dean at the MIT Sloan School of Management, Microsoft should have $500,000 in revenue per employee, or at least a minimum of $300,000. Investors looking at the annual or quarterly report worry about the headcount when it starts to decline. Companies often face revenue problems rather than cost problems, says Jeffrey Pfeffer, a Stanford Graduate School of Business professor.

Software companies invest heavily in research and development in order to create new software products and services. Microsoft, after letting go of 10,000 employees, announced almost immediately that it would be investing $10 billion in ChatGPT maker OpenAI and spending a sum that would be equal to $1 million for each laid-off employee. Similarly, Google’s parent company, Alphabet, let go of 12,000 employees worldwide in January 2023, or approximately 6% of its whole staff. Sundar Pichai, CEO of Google, said the job cuts were necessary to “direct our talent and capital to our highest priorities,” namely, Google’s new AI-powered ChatGPT competitor, Bard. This clearly demonstrates the economic motivation of the tech industry at its core.

What could happen next?

The US economy depends heavily on the spending of the top 20%, and tech employees, who are frequently well-paid, are among the wealthiest consumers. Layoffs can lead to an increase in the supply of homes. This is because laid-off workers may need to sell their homes to relocate or downsize their living expenses. Many cities are seeing a minor decline of 3.1% in home values that have continued to fall over the past few months after a record-breaking year of home price growth in 2022. It is normal for housing prices to slow down now that the pandemic is over and interest rates are going up. The declining home values are likely to continue for some time as the US government/continue to take steps to cool the housing market. Additionally, a 40-year high in inflation has depleted the earnings and savings of workers. Consumer spending has declined as a result of this. The Federal Reserve is raising interest rates in an effort to combat inflation. As interest rates have begun to rise, investors have become more risk-averse. This has led to a sell-off in growth stocks, including tech stocks. Typically, the advertising industry is the first to suffer during a recession. This is due to the perception that advertising is not necessary for a business’s everyday operations. Instead, it is viewed as a financial investment in the company’s future expansion and identity. This could have a big effect on the company’s reputation and long-term growth potential. When businesses are laying off workers, they may be less likely to export goods and services to other countries. A study by the World Bank found that a 1% increase in unemployment in a country was associated with a 0.5% decrease in exports. This decline in trade further slows economic growth.

The increase in unemployment led to a decrease in tax revenue and an increase in government spending on unemployment benefits. According to the Bureau of Labor Statistics, the unemployment rate in the US increased from 3.8% in March 2023 to 4.0% in April 2023. The U.S. Bureau of the Census reported that federal income tax collections decreased by 0.4% in April 2023, from $420.2 billion to $418.3 billion. President Joe Biden proposed cutting taxes for businesses and individuals as part of his American Jobs Plan. The plan would cut the corporate tax rate from 21% to 19% and the top individual income tax rate from 37% to 39.6%. The plan would also increase the standard deduction for individuals and families and make the child tax credit fully refundable. The Biden administration argues that investing in infrastructure will create jobs and boost economic growth. The plan would invest $180 billion in research and development, including $100 billion for the National Science Foundation, which focuses on programs to promote the adoption of new technologies such as electric vehicles, smart grids, and advanced manufacturing. This would help create demand for tech products and services. The plan is expected to create 2 million jobs in the construction industry and 1.4 million jobs in other industries. The plan is also expected to boost economic growth by $2.3 trillion over the next decade.

Since the tech sector is always changing, it’s critical to keep on top of things by learning about cutting-edge technologies. This can increase employability for employers and reduce the chance of being laid off. Networking is a great way to learn about new job opportunities and connect with people.

Sources:

- The Real Reasons For Big Tech Layoffs At Google, Microsoft, Meta, And Amazon

- The outlook is uncertain again amid financial sector turmoil, high inflation, ongoing effects of Russia’s invasion of Ukraine, and three years of COVID

- The Crunchbase Tech Layoffs Tracker

- What the Tech and Media Layoffs Are Really Telling Us About the Economy

- What the wave of tech layoffs tell us about the economy