A significant rise in bank borrowing from the Federal Home Loan Bank (FHLB) system and the recently established Bank Term Funding Program (BTFP) is compelling evidence of another potential wave of banking failures.

What is happening?

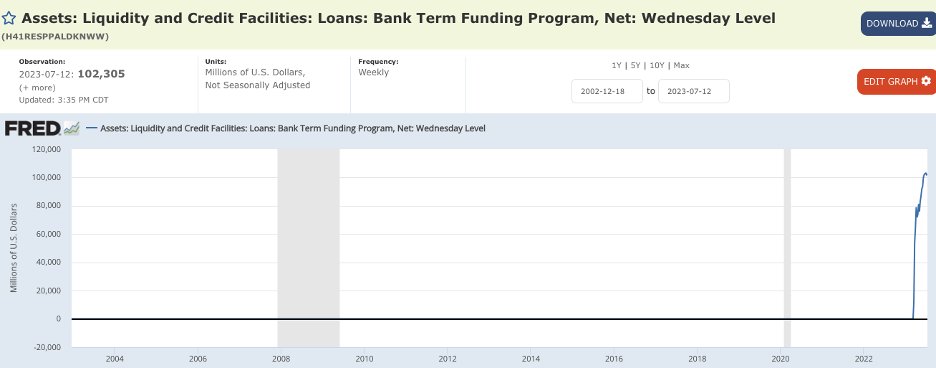

The Federal Reserve System serves as the lender of last resort by providing liquidity to insured financial institutions in the US. The Bank Term Funding Program (BTFP) is an emergency initiative introduced by the Federal Reserve in March 2023 to offer extra liquidity to depository institutions in the United States. It was established in response to the bank failures of Signature Bank and Silicon Valley Bank, which were the largest bank collapses since the 2008 financial crisis.

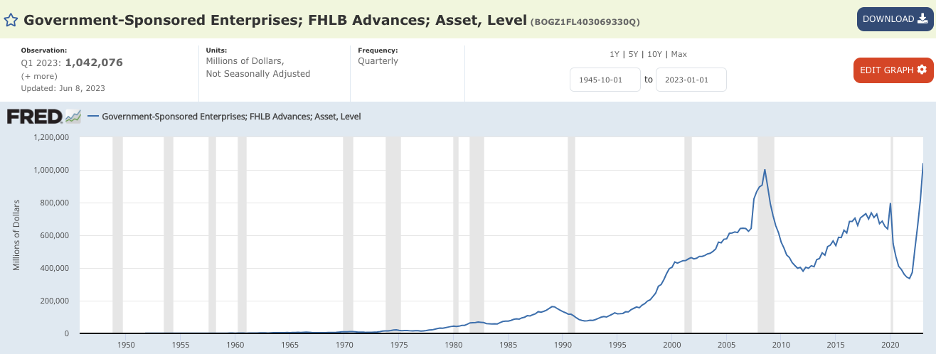

The Federal Home Loan Bank (FHLB) system, established in 1932 to aid small and community banks in extending mortgages during the Great Depression, has transformed into a crucial funding source for regional banks. It serves as a lender of second-to-last resort, allowing distressed banks to access loans for real estate – called advances. Troubled banks can present the lacking capital as mortgage-related funding, while redirecting the funds as needed.

In 2007, there was a significant jump in FHLB issued. The advances from the FHLB started rising before Lehman Brothers and Bear Stearns failures, suggesting that the banking crisis in 2008 could’ve been predicted by this jump. From Q1 2022 to Q4 2022, there was a similar jump in FHLB as in 2007. In Q1 2023, we had the three big banks failing. Each one of the three failed banks was in the top 7 borrowers of short-term FHLB advances.

What is causing it?

When troubled banks require liquidity, their initial option, due to its affordability, tends to be the marketplace, including the repo market. The repo market is a marketplace for collateralized short-term loans, where one party sells securities to another and agrees to repurchase them later at a higher price. Troubled banks with liquidity issues face difficulties in obtaining repurchase agreements because of their credit risk and lenders’ potential inability to collect collateral. Considering these risks, the repo market isn’t an option, as hurting banks turn to the FHLB as their next best alternative. Accessing the FHLB is considered a stealth bailout – not easily recognizable or transparent to the public, although it is expensive with often stringent terms that ensure the FHLB gets paid in full in case of a default. If the FHLB is unwilling to extend loans to troubled institutions, they must resort to the Federal Reserve and attempt to access facilities like the BTFP and discount window. The discount window is a facility provided by the central bank that provides commercial banks with short-term loans, typically with very brief durations, often limited to overnight lending. The Federal Reserve’s discount window acts as a backup source of funding for banks that are unable to use the market to satisfy an urgent need for liquidity. Being the very last resort of funding, many analysts refer to this facility as banking suicide because the market can recognize the banks’ vulnerability, further harnessing the institutions’ ability to get liquidity from market-based sources in the future.

What could happen next?

The surge in FHLB advances, coupled with the overflow of the Bank Term Funding Program (BTFP), indicates that numerous banks are unable to access funds from the repo market or the FHLB. This suggests that the banking crisis is far from over. By monitoring the spending in FHLB advances, BTFP, and participation in the discount window, it may be possible to anticipate further bank failures in the coming weeks or months. These developments signal the need for additional intervention and underscore the ongoing challenges faced by troubled financial institutions.

Kathryn Judge, a professor of Law at Columbia Law School, suggests that implementing a cap on the FHLBank’s advances to member institutions at 2% of outstanding advances could be an effective measure. This limitation would serve to prevent larger troubled banks from exploiting FHLBank advances to postpone the reckoning. Moreover, it would redirect the system’s focus towards benefiting community banks rather than favoring larger counterparts.

For Further Reading

Forbes- How You Can Monitor The Severity Of The U.S. Banking Crisis

Sources:

- George Gammon’s Youtube Channel – WARNING: 2nd Wave Of Banking Crisis Coming!! https://www.youtube.com/watch?v=4Rz6UfU3dQc

- The America Prospect – The Problem Lender of Second-to-Last Resort

- https://prospect.org/economy/2023-03-29-problem-lender-federal-home-loan-banks/

- Investopedia – Bank Term Funding Program https://www.investopedia.com/bank-term-funding-project-7367897

- Investopedia – Federal Home Loan Bank – https://www.investopedia.com/terms/f/fhlb.asp#What%20Is%20The%20Federal%20Home%20Loan%20Bank%20System%20(Fhlb)

- Investopedia – Discount Window – https://www.investopedia.com/terms/d/discountwindow.asp

- Investopedia – Repurchase Agreement – https://www.investopedia.com/terms/r/repurchaseagreement.asp#Risks%20of%20Repo

- Hunter – @vanclvg on Twitter – https://twitter.com/vanclvg/status/1675191645149757440