Four countries in South America are contemplating creating a common currency that would lead to a decreased use of the U.S. dollar and further dedollarization.

What’s happening:

Brazilian President, Luiz Inácio Lula da Silva proposed a common currency among the Mercosur trade bloc, which includes Argentina, Brazil, Paraguay, and Uruguay. This idea was proposed at a meeting with South American heads of state. Argentina’s inflation rate in May was 126.4% and this has led to an increase in pricing for products and negatively affected everyday Argentinians.

What’s causing this to happen:

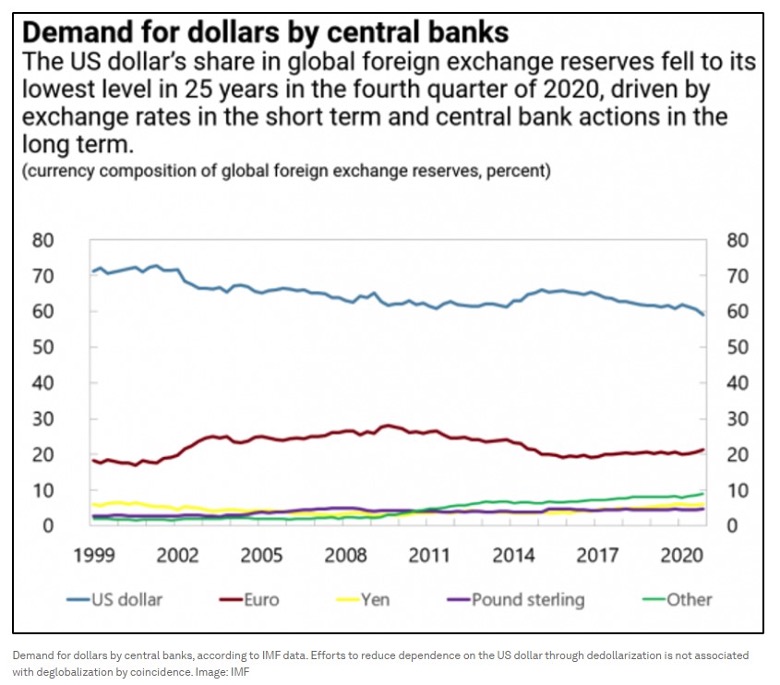

President Lula believes that having a common currency among some of the countries in South America will provide an opportunity to gain experience in the South American economy. He also wants to “strengthen the South American identity in monetary policy.” With all the economic uncertainty in the world right now, South America could band together to protect its economies from larger ones in case those economies fail. The European Union is following a similar idea as it is working toward relying less on the dollar and more on other currencies including the Euro. As seen in the graphic below, there has been about a 10% drop in the demand for the dollar while the demand for the euro could potentially be on the rise according to the International Monetary Fund. Both the EU and the Mercosur bloc think this switch to relying less on the dollar will benefit their members because none of their national currency is the dollar.

What could happen next:

While it is unlikely that a common currency could be implemented in the next two years, there is a possibility that it will be implemented within three years. The main goal of doing this is to create a way for the countries to conduct trade without having to use the dollar to do so. Most countries are relying less on the dollar and forming their currencies to conduct business in. South America is simply following the rest of the world when it comes to encouraging dedollarizaion. Argentina, Paraguay, and Uruguay all accept the dollar as currency already and it is the second largest used in the countries behind each country’s native currency. Brazil, however, still does not accept the dollar as currency.

If a common currency is formed, there could be an increase in trade among these countries and they would rely more on each other and less on the U.S. In 2019 The U.S. traded an estimated $23.3 billion, comprising of $15.7 billion from exports and $7.5 billion from imports, creating an $8.2 billion trade surplus that year. In 2022, the U.S. received a surplus of $14,925. 8 million from Brazil, $6,061.8 million from Argentina, $1,850.5 million from Paraguay, and $2,015.6 million from Uruguay. The U.S. could see a decrease in trade with these four countries especially using the dollar. If the U.S. wanted to continue to trade after a common currency was introduced, then the countries might force the U.S. to use their common currency rather than the dollar.

If the Mercosur trade bloc decides to create a common currency within the next few years, then that will likely lead to even fewer countries using the dollar and increase the trend toward dedollarization.

Sources:

- https://www.census.gov/foreign-trade/balance/c3510.html

- https://www.census.gov/foreign-trade/balance/c3570.html

- https://www.census.gov/foreign-trade/balance/c3530.html

- https://www.census.gov/foreign-trade/balance/c3550.html

- https://www.csis.org/analysis/south-americas-common-currency-actually-about-de-dollarization

- https://new.finalcall.com/2023/06/13/brazil-calls-for-common-south-american-currency/

- https://www.nasdaq.com/articles/argentina-inflation-seen-at-126.4-in-2023-central-bank-poll-shows#:~:text=BUENOS%20AIRES%2C%20May%205%20(Reuters,of%20analysts%20released%20on%20Friday.